Within the fast-evolving panorama of economic companies, Anti-Cash Laundering (AML), Know Your Buyer (KYC), and compliance practices proceed to play pivotal roles in safeguarding towards monetary crimes and making certain regulatory adherence. As we step into 2024, these cornerstones of economic integrity have undergone vital transformations, spurred by technological developments, regulatory updates, and rising world challenges. Understanding the nuances of AML, KYC, and compliance, in addition to discerning the most recent traits and greatest practices, is indispensable for monetary establishments aiming to navigate this complicated terrain successfully. On this weblog, we delve into the variations between AML, KYC, and compliance in 2024, whereas additionally exploring the simplest methods and practices to remain forward on this dynamic regulatory setting.

Think about your cash as a spaceship navigating by way of the universe of funds. Ever puzzled the way it stays protected from invisible threats? Properly, buckle up as we embark on a monetary journey the place AML, KYC, and Compliance act like cosmic guardians, protecting your cash spaceship safe. Prepared for the journey?

Understanding AML, KYC, and Compliance

Anti-Cash Laundering (AML)

AML includes measures and rules aimed toward stopping criminals from disguising illegally obtained funds as legit earnings. Suppose a prison group earns cash by way of unlawful actions similar to drug trafficking. AML measures would come with banks and monetary establishments implementing procedures to detect and report suspicious transactions, stopping the combination of illicit funds into the legit monetary system.

Levels of the AML Course of

Identification and Verification:

- Confirm the identification of consumers by way of dependable paperwork.

- Use know-how like biometrics for enhanced verification.

Danger Evaluation and Due Diligence:

- Consider the chance linked to every buyer.

- Conduct due diligence checks based mostly on the recognized threat stage.

Monitoring and Reporting:

- Monitor buyer transactions for suspicious actions.

- Report and examine any recognized suspicious transactions promptly.

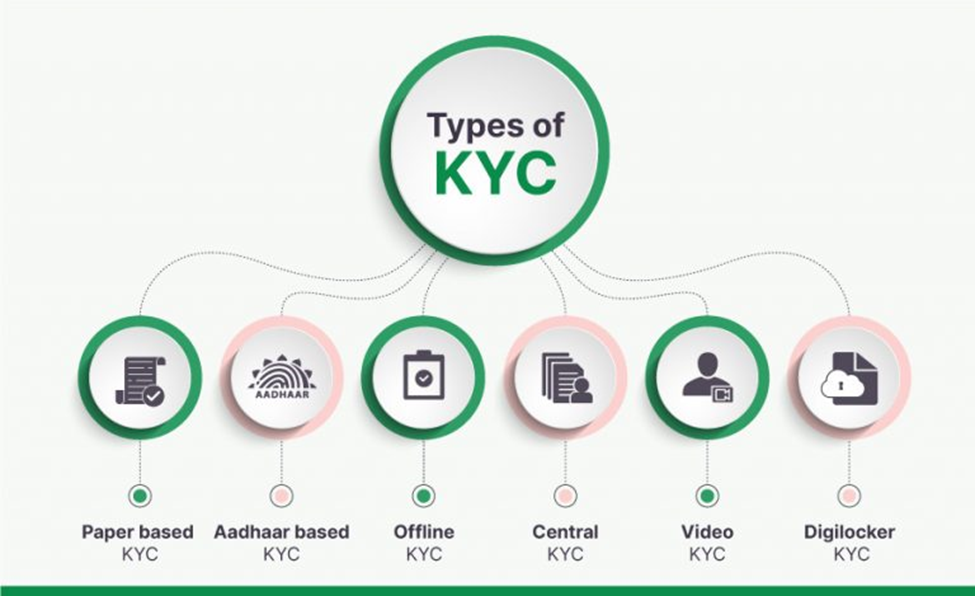

Know Your Buyer (KYC)

KYC is a course of companies use to confirm and perceive the identification of their clients, lowering the chance of fraud and illicit actions.

Instance: When somebody opens a brand new checking account, the financial institution will ask for identification paperwork, proof of handle, and probably details about the supply of earnings. This KYC course of helps the financial institution make sure that the client is a legit particular person and never utilizing the account for unlawful functions.

Levels of the KYC Course of

Buyer Identification:

- Acquire and confirm buyer identification by way of dependable paperwork.

- Make the most of know-how, similar to biometrics, for superior identification.

Danger Evaluation and Profiling:

- Assess the chance related to every buyer based mostly on supplied data.

- Create threat profiles to find out the extent of scrutiny required.

Ongoing Monitoring:

- Repeatedly monitor buyer transactions and actions.

- Replace buyer profiles and conduct periodic critiques for adjustments in threat.

Compliance

Compliance includes adhering to guidelines, rules, and legal guidelines established by governing our bodies to make sure moral and authorized enterprise operations.

Levels of the Compliance Course of

Regulatory Understanding:

- Attain a radical grasp of relevant rules.

- Establish relevant regulatory frameworks for the {industry} and jurisdiction.

Coverage Improvement:

- Set up sturdy insurance policies and procedures for compliance.

- Outline particular necessities for actions like buyer onboarding, due diligence, and reporting.

Implementation and Monitoring:

- Implement compliance measures throughout the group.

- Monitor adherence to insurance policies, conduct common audits, and adapt to evolving regulatory landscapes.

Instance: Think about a monetary establishment is required by legislation to report massive transactions to the federal government to fight cash laundering. Compliance on this context would contain the establishment constantly following this rule, reporting transactions that meet the required standards to keep up transparency and cling to authorized necessities.

Evolution of AML, KYC, and Compliance

Historic context of AML, KYC, and Compliance

- AML Origins: Rising from issues about unlawful funds moving into monetary techniques.

- KYC Improvement: Rising because of the rising complexity of worldwide monetary transactions.

- Compliance Basis: Rooted in authorized frameworks, adjusting to societal adjustments over time.

Milestones and regulatory adjustments over time:

| Laws/Initiative | Yr | Significance |

| Financial institution Secrecy Act (1970) | 1970 | Launched world record-keeping for AML. |

| Basel Committee (1989) | 1989 | Introduced in world AML rules. |

| USA PATRIOT Act (2001) | 2001 | Strengthened AML globally and expanded KYC necessities. |

| EU Cash Laundering Directive (2005) | 2005 | Strengthened AML rules within the EU and launched risk-based KYC. |

| FATCA (2012) | 2012 | Tackled world tax evasion, impacting KYC practices. |

| GDPR (2018) | 2018 | A landmark in knowledge safety, influencing Compliance practices in KYC. |

Industries implementing AML, KYC, and Compliance practices

Present Panorama of AML, KYC, and Compliance in 2024

Overview of AML, KYC, and Compliance in 2024

- AML (Anti-Cash Laundering): Stays foundational for detecting and stopping illicit monetary actions. Stringent rules and superior monitoring techniques improve safeguards.

- KYC (Know Your Buyer): Evolving with elevated reliance on digital identification verification instruments. Know-how integration enhances accuracy and effectivity in buyer identification checks.

- Compliance: Increasing to cowl a broader spectrum of rules. Companies undertake complete methods to satisfy AML, KYC, and numerous world industry-specific rules.

Adapting to the Regulatory Panorama: AML and KYC Developments in 2024

Evolving Laws:

- Ongoing evolution of AML/KYC and helpful possession rules, significantly within the EU.

- Steady efforts required for compliance in response to dynamic regulatory adjustments.

Harmonization Challenges:

- CTA (Cryptocurrency Transaction Evaluation) and 6AMLD (Sixth Anti-Cash Laundering Directive) updates goal for harmonization however current challenges in cross-border compliance.

- Monetary establishments grappling with complexities to align with new regulatory frameworks.

Cryptocurrency Scrutiny:

- Cryptocurrencies going through elevated scrutiny for alignment with AML, counter-terrorism financing, and sanctions guidelines.

- Regulators specializing in bringing cryptocurrency actions according to established monetary compliance norms.

Automation for BOI Accuracy:

- Challenges in acquiring correct Useful Possession Info (BOI) throughout jurisdictions.

- Rising significance of automation in monetary establishments for environment friendly and correct BOI processes.

Useful resource Administration and Tech Upgrades:

- Ample resourcing and budgeting are important for know-how upgrades.

- Monetary establishments making ready for elevated workloads ensuing from a surge in suspicious exercise studies.

Influence Evaluation and Strategic Response:

- Monetary establishments conducting assessments of latest rules’ impacts on compliance processes, knowledge necessities, and staffing.

- Strategic planning to navigate adjustments successfully in response to evolving regulatory shifts.

Click on right here to know extra: AML KYC – Compliance Developments and Laws 2024

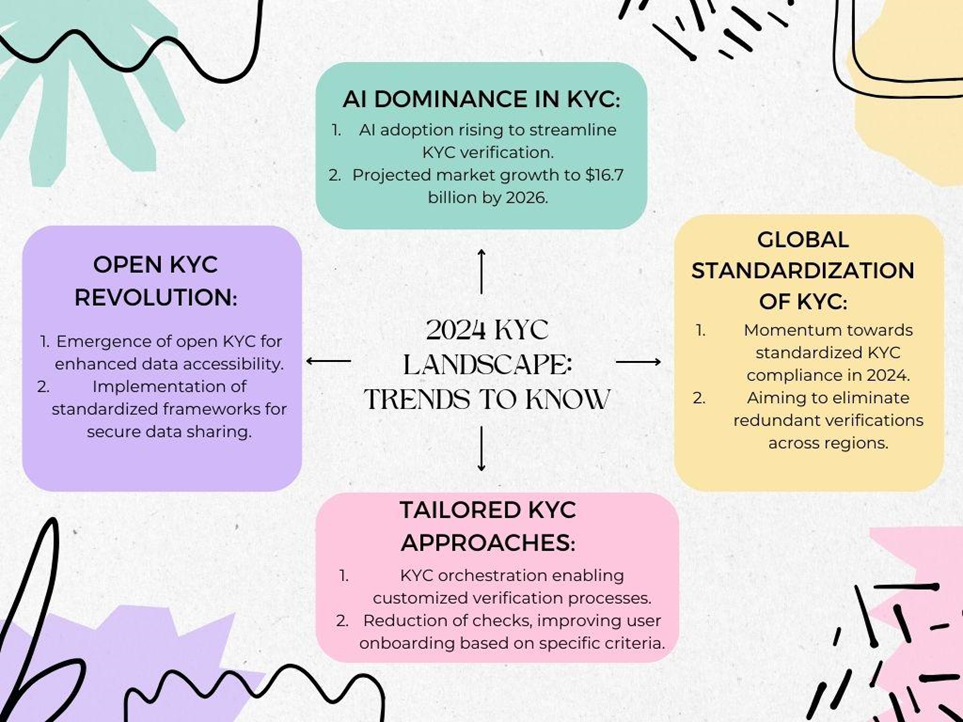

2024 KYC Panorama: Developments to Know

Notable Adjustments or Developments in Know-how Impacting Practices

| Know-how Impacting Practices | Description |

| Blockchain in AML | Blockchain know-how is gaining prominence in AML efforts, offering a clear and immutable ledger for monetary transactions. This enhances traceability and helps in detecting suspicious actions. |

| AI and Machine Studying in KYC | Superior analytics powered by AI and machine studying are revolutionizing KYC processes. These applied sciences allow faster and extra correct buyer identification verification, lowering the chance of fraudulent actions. |

| RegTech Options | The rise of Regulatory Know-how (RegTech) options is streamlining compliance processes. Automated instruments and platforms assist companies keep compliant by effectively managing regulatory necessities, reporting, and audits. |

Transformation Overview of AML/KYC Panorama in 2024

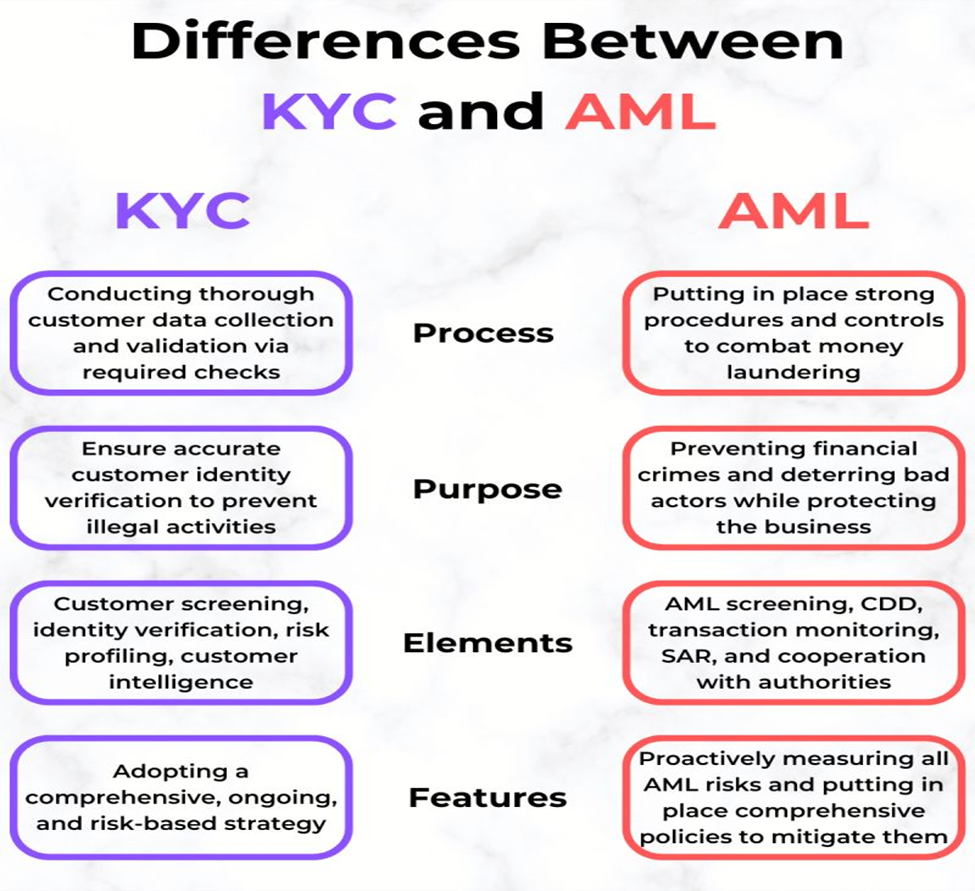

Key Variations of AML and KYC in 2024

Click on right here to know extra in regards to the Key Variations of AML and KYC

Important Adjustments in AML and KYC Laws

- Overview: Important adjustments in AML and KYC rules mirror world developments and evolving dynamics.

- Technological Integration: Laws embrace superior applied sciences for enhanced effectivity and accuracy in compliance.

- International Requirements: Initiatives to standardize AML and KYC practices globally goal to cut back redundancies for cross-border companies.

Affect of Know-how Developments

- Technological Integration: Laws combine technological options to streamline AML and KYC processes effectively.

- AI and Machine Studying Influence: AI implementation enhances threat evaluation and fraud detection capabilities inside compliance frameworks.

- Automation for Effectivity: Automated processes are employed to reinforce the effectivity of AML and KYC procedures.

New Necessities or Expectations for Companies in 2024

- Enhanced Due Diligence (EDD): Companies are actually encountering heightened necessities for due diligence, demanding a extra complete examination of buyer backgrounds, transactions, and potential dangers.

- Actual-Time Monitoring: There may be an rising emphasis on monitoring monetary transactions in real-time, enabling companies to promptly establish and handle any suspicious actions. This shift enhances the effectiveness of fraud detection and prevention.

- Adaptive Compliance Methods: Companies are anticipated to embrace adaptive compliance methods able to evolving in response to the dynamic nature of economic crimes and regulatory adjustments. This proactive strategy ensures ongoing effectiveness in stopping illicit monetary actions.

Methods for Profitable Compliance in 2024

The optimum methods for companies to keep up and excel in compliance with the most recent rules.

Greatest Practices for Compliance Excellence

Proactive Danger Evaluation:

- Usually assess and establish potential dangers and vulnerabilities.

- Implement preventive measures to mitigate recognized dangers.

Strong Insurance policies and Procedures:

- Set up clear, complete, and up-to-date compliance insurance policies.

- Guarantee insurance policies align with present regulatory necessities.

Worker Coaching:

- Conduct common coaching classes to coach staff on compliance protocols.

- Preserve the workforce knowledgeable in regards to the newest regulatory updates.

Steady Monitoring:

- Implement techniques for ongoing monitoring and analysis of compliance actions.

- Make the most of know-how to automate monitoring processes and improve accuracy.

Turn out to be Licensed AML-KYC Compliance Officer

Significance of a Strong Compliance Framework

- Emphasize the importance of a well-structured compliance framework.

- Focus on the function of know-how in enhancing compliance efforts, similar to automated monitoring and reporting techniques.

Know-how’s Function in AML and KYC

Influence:

- Enhances AML and KYC processes, making certain operational effectivity.

- Allows real-time identification of suspicious actions.

- Facilitates synchronized world compliance efforts.

Superior Applied sciences:

- Makes use of AI for exact identification of cash laundering patterns.

- Adapts ML to evolving patterns, enhancing threat assessments.

- Streamlines duties by way of automation, lowering errors.

Challenges and Dangers:

- Elicits issues about knowledge privateness, requiring sturdy measures.

- Addresses algorithmic bias by way of common auditing.

- Manages integration challenges for seamless know-how adoption.

Why AML, KYC, and Compliance are Necessary

Essential Function in Stopping Monetary Crimes

AML (Anti-Cash Laundering):

- Identification and Prevention: AML processes are essential in figuring out and stopping the combination of illegally obtained funds into the monetary system.

- Safeguarding Monetary Establishments: AML measures safeguard monetary establishments from unwittingly facilitating cash laundering actions.

KYC (Know Your Buyer):

- Identification Verification: KYC practices play a pivotal function in verifying buyer identities, lowering the chance of identification theft and fraudulent actions.

- Transaction Authorization: Figuring out the client permits companies to authorize transactions with confidence, stopping unauthorized and probably illicit actions.

Compliance:

- Moral Enterprise Operation: Compliance ensures companies function ethically, transparently, and in adherence to rules.

- Danger Mitigation: Compliance practices mitigate dangers, establish potential unlawful actions, and contribute to the general integrity of the monetary system.

Actual-World Examples

HSBC Cash Laundering Scandal (2012):

- Significance of AML: HSBC confronted extreme penalties for facilitating cash laundering, emphasizing the important function of sturdy AML measures in stopping such scandals.

Equifax Knowledge Breach (2017):

- Significance of KYC: The Equifax breach highlighted the necessity for robust KYC practices to guard buyer identities and stop unauthorized entry to delicate data.

Wells Fargo Account Fraud (2016):

- Significance of Compliance: Wells Fargo’s account fraud scandal underscored the importance of compliance in sustaining moral enterprise practices and avoiding fraudulent actions.

Impactful AML, KYC, and Compliance Case Research

In opposition to tax evasion methods and strategies exist to help financial foundations with combating unlawful tax avoidance by protecting lawbreakers from collaborating in exchanges which might be painstakingly masked that are related to prison operations.

Despite the fact that it’s simple for us to maintain stressing how vital KYC and AML processes are, you won’t understand how a lot it might value your small business if they’re carried out mistaken or ignored. This isn’t simply since you might lose cash and your popularity, but additionally since you might face official sanctions and punishment should you break KYC and AML necessities in regulated industries like finance.

To understand that it’s so important to ensure your KYC and AML methods are distinctive, we should always take a gander at a few instances recently, and their outcomes.

Falcon Non-public Financial institution:

One of the vital infamous instances within the {industry} up to now, Falcon Non-public Financial institution confronted extreme penalties, together with the withdrawal of its service provider financial institution standing and a fantastic of S$4.3 million. The Financial Authority of Singapore (MAS) cited critical failures of their AML controls and improper conduct by senior administration, permitting the financial institution for use in Malaysia’s 1MDB embezzlement scandal.

Financial institution J Safra Sarasin:

In April 2021, MAS imposed a composition penalty of S$1 million on Financial institution J Safra Sarasin for vital breaches of AML necessities between March 2014 and September 2018. The financial institution’s lapses in AML management procedures throughout buyer onboarding and ongoing monitoring elevated the chance of getting used for unlawful actions.

Function of AML, KYC, and Compliance in stopping monetary crimes

| Facet | AML (Anti-Cash Laundering) | KYC (Know Your Buyer) | Compliance |

| Function | Identifies and prevents the combination of illegally obtained funds into the monetary system. | Verifies buyer identities, lowering the chance of identification theft and fraudulent actions. | Ensures companies function ethically, transparently, and in adherence to rules. |

| Influence | Safeguards monetary establishments from unwittingly facilitating cash laundering actions. | Prevents unauthorized transactions and ensures a radical understanding of buyer habits. | Mitigates dangers, identifies potential unlawful actions, and contributes to the integrity of the monetary system. |

2024 Imaginative and prescient: Transformations in Apply

Navigating the Future

Dynamic Panorama: The AML, KYC, and Compliance panorama is ever-evolving, requiring fixed vigilance and adaptation to remain forward.

Technological Integration: Developments in know-how, together with AI and automation, play a pivotal function in enhancing the effectiveness of AML, KYC, and Compliance processes.

Adaptive Compliance: Companies should undertake adaptive compliance methods, emphasizing real-time monitoring, proactive threat evaluation, and steady coaching to navigate the complicated regulatory setting.

Significance of Adapting to Adjustments

Adapting to adjustments isn’t just a necessity however a strategic crucial. It ensures companies stay resilient, compliant, and able to mitigating rising dangers within the monetary sector. Steady evolution in methods and applied sciences is crucial to remain forward of economic crimes and keep belief.

Offering Sources

For these searching for additional data or staying up to date on AML, KYC, and Compliance:

- Regulatory Authorities: Usually verify updates from monetary regulatory authorities for the most recent pointers.

- Business Publications: Discover {industry} publications and journals protecting monetary rules, offering in-depth insights and analyses.

- Skilled Networks: Be a part of skilled networks and boards to have interaction with consultants, focus on rising traits, and share greatest practices.

- Coaching Applications: Enroll in specialised coaching applications and programs to reinforce abilities and keep abreast of the most recent compliance necessities.

Instruments employed for AML, KYC and Compliance functions

Varied instruments play a vital function in Anti-Cash Laundering (AML), Know Your Buyer (KYC), and Compliance efforts:

Buyer Due Diligence (CDD) Instruments:

- Confirm and perceive clients’ backgrounds.

- Establish potential dangers and guarantee compliance with rules.

Identification Verification Options:

- Use biometrics, doc verification, and digital identification checks.

- Authenticate buyer identities securely.

Transaction Monitoring Techniques:

- Automate monitoring and evaluation of economic transactions in real-time.

- Detect suspicious actions and stop cash laundering.

Regulatory Reporting Software program:

- Streamline the technology and submission of studies required by regulatory authorities.

- Guarantee compliance with reporting obligations.

Danger Evaluation Software program:

- Consider the chance related to clients, transactions, or enterprise relationships.

- Improve decision-making processes.

Blockchain Analytics:

- Monitor and analyze transactions on blockchain networks.

- Establish illicit actions related to cryptocurrencies.

AI and ML Instruments:

- Improve KYC processes, threat evaluation, and fraud detection.

- Use superior analytics and sample recognition.

Cybersecurity Options:

- Shield delicate buyer knowledge and make sure the integrity of compliance processes.

- Guard towards cyber threats and unauthorized entry.

Knowledge Administration Techniques:

- Successfully handle and safe massive volumes of information.

- Guarantee accuracy and facilitate seamless compliance processes.

Collaboration Platforms:

- Allow communication and information-sharing amongst monetary establishments, regulators, and know-how suppliers.

- Improve collective efforts in combating monetary crimes.

These instruments collectively contribute to a strong framework for monetary establishments, regulators, and companies to navigate the complexities of AML, KYC, and Compliance.

Study extra about instruments right here: Click on right here

Instruments devoted to particular capabilities inside KYC, AML, and Compliance domains, offering organizations with tailor-made options for his or her regulatory wants.

| KYC Instruments | AML Instruments | Compliance Instruments |

| SEON | SEON | Sprinto |

| Onfido | ComplyAdvantage | Connecteam |

| Trulioo | Acuris Danger Intelligence | SiteDocs |

| Refinitiv | OFAC (Workplace of Overseas Property Management) | Qualtrax |

| KYC-Chain | SumSub | PowerDMS |

| Token of Belief | Token of Belief | QT9 |

In 2024, AML, KYC, and compliance demand a proactive stance. Understanding regulatory nuances, implementing greatest practices, and embracing superior applied sciences are essential. Non-compliance dangers regulatory actions, emphasizing the necessity for sturdy frameworks. Steady monitoring, adaptive methods, and ongoing coaching are key for achievement. A holistic strategy fosters resilience and integrity within the evolving monetary panorama.

AML KYC Complaince Incessantly Requested Questions

Q1: Why are AML and KYC essential in 2024?

- A: AML (Anti-Cash Laundering) and KYC (Know Your Buyer) play an important function in making certain monetary integrity. They thwart illicit monetary actions, improve transparency, and align with evolving regulatory requirements.

Q2: How can companies navigate evolving AML/KYC rules?

- A: Companies can keep compliance by actively monitoring regulatory updates, establishing sturdy compliance frameworks, and harnessing know-how for environment friendly AML/KYC processes.

Q3: Why is know-how integration important for AML and KYC practices?

- A: Know-how enhances precision and effectivity in AML and KYC processes. The incorporation of AI, machine studying, and automation streamlines compliance, offering real-time insights and threat assessments.

This autumn: What are the repercussions of AML non-compliance?

- A: Non-compliance carries extreme penalties, together with hefty fines, authorized repercussions, injury to popularity, and missed enterprise alternatives. Sustaining vigilance is crucial.

Q5: How can companies guarantee steady compliance in a dynamic panorama?

- A: Companies ought to conduct common inside audits, keep abreast of {industry} greatest practices, put money into worker coaching, and adapt AML/KYC processes to evolving threats.

Q6: What function does automation play in AML and KYC procedures?

- A: Automation streamlines AML and KYC procedures, facilitating fast and correct transaction monitoring, buyer due diligence, and compliance reporting, thereby lowering handbook errors.

Q7: How do AML and KYC contribute to a safe monetary ecosystem?

- A: AML and KYC practices set up a safe monetary setting by stopping cash laundering, fraud, and illicit actions. They promote belief, transparency, and adherence to regulatory compliance.

Q8: What are the important thing traits influencing AML compliance in 2024?

- A: Developments embody heightened regulatory focus, integration of superior applied sciences like blockchain and AI, emphasis on steady monitoring, and the need for world collaboration.

Content material Creator: Jyoti Rawat, an achieved Digital Advertising and E-commerce Supervisor with over 9 years of expertise. Graduated with a B.Tech in Pc Engineering, along with a ardour for curating content material that educates, connects, and drives engagement. Dedicated to delivering high quality work, she goals to equip people with the information wanted to navigate the digital panorama confidently, fostering significant interactions and knowledgeable decision-making.

+ There are no comments

Add yours